Should we give up on Digital Therapeutics (DTx)?

In 2019 the DiGA framework in Germany brought hope to the future of digital therapeutics, but by 2024 so far, we have seen more struggles than successes with DTx.

This is a newsletter of Faces of Digital Health - podcast that explores the diversity of healthcare systems and healthcare innovation worldwide. Interviews with policymakers, entrepreneurs, and clinicians provide the listeners with insights into market specifics, go-to-market strategies, barriers to success, characteristics of different healthcare systems, challenges of healthcare systems, and access to healthcare. Find out more on the website, tune in on Spotify or iTunes.

Currently, there are 64 applications in the DiGA repository in Germany. By January 2024, six applications were removed due to various issues faced by the companies. In 2023, France introduced the PECAN framework for the approval and reimbursement of digital solutions, including telemedicine and DTx. By June 2024, four solutions completed the approval process, with one solution for telemonitoring being approved. Three were rejected for various reasons, resulting in a 75% rejection rate, as noted by Elsa Duteil at the DTx France 2024 conference in July. In the U.S. companies stopped waiting for reimbursement codes and are focusing on value-based care and innovation in business models. Why is progress with DTx so slow?

First, a history lesson.

I still remember the confusion around digital health apps in 2017: Are innovators onto something? Is it all just hype? The number of digital health smartphone apps kept rising and we stopped counting them once their count surpassed 350,000. It became clear the industry needed more differentiation and new labels in this sea of solutions.

Digital health categories according to the Digital Therapeutics Alliance.

That marked the birth of digital therapeutics - digital solutions that, by definition, should have a therapeutic impact on patient outcomes, proven in clinical trials. We celebrated the first FDA-approved prescription digital therapy reSET, a product for treating substance use disorders, in 2017, designed by Pear Therapeutics - the rising star in the digital health space… until it filed for bankruptcy in 2023 and sent shivers through the industry.

Many other solutions were subsequently approved by the FDA, and a lot of these were categorized as requiring a prescription. The idea was, that this would encourage regulators to speed up development of reimbursement models. Some companies chose to go public, but are now facing low valuations and declining stock prices. (Read this in-depth analysis by investor Marko Kuisma for more details and a VC perspective).

As a patient, I often regretted the decision for prescription-only approaches because it meant limited availability. A few years later, due to lack of success with prescriptions, companies are moving away from not being available directly to consumers.

In my opinion, this is good because many digital therapeutics are aimed at mental health and are based on cognitive-behavioral therapy principles. With the shortage of mental health professionals, patients are scrambling to find solutions on their own. Having the option to try DTx as a consumer is a ray of hope.

The Challenge With Innovation in Healthcare

As with any innovation, it soon became apparent that we need a pathway to include digital therapeutics in healthcare provision. Several things usually need to happen to enable this:

The solution needs solid evidence of efficacy and impact on patient outcomes.

Medical experts need to agree the solution has medical merit, and potentially be excited about it. The impact is presented in the medical community, and hopefully, the use of an innovation will gradually spread. With use comes more data and insights into the real-world applications.

If successful, the solution then gets reimbursed by insurance companies, which first want the green light from the medical community, a cost-benefit analysis on treatment outcomes, and often a push from the legislators. Easy.

Ironically, there is a general consensus in healthcare that digitalization is an integral part of healthcare delivery because it will bring transparency, optimization, and more. We want digital data, audit trails, and data pools for data mining, algorithms, and AI development. We often get stuck, however, with the resistance to change the existing delivery models.

Look at Belgium!

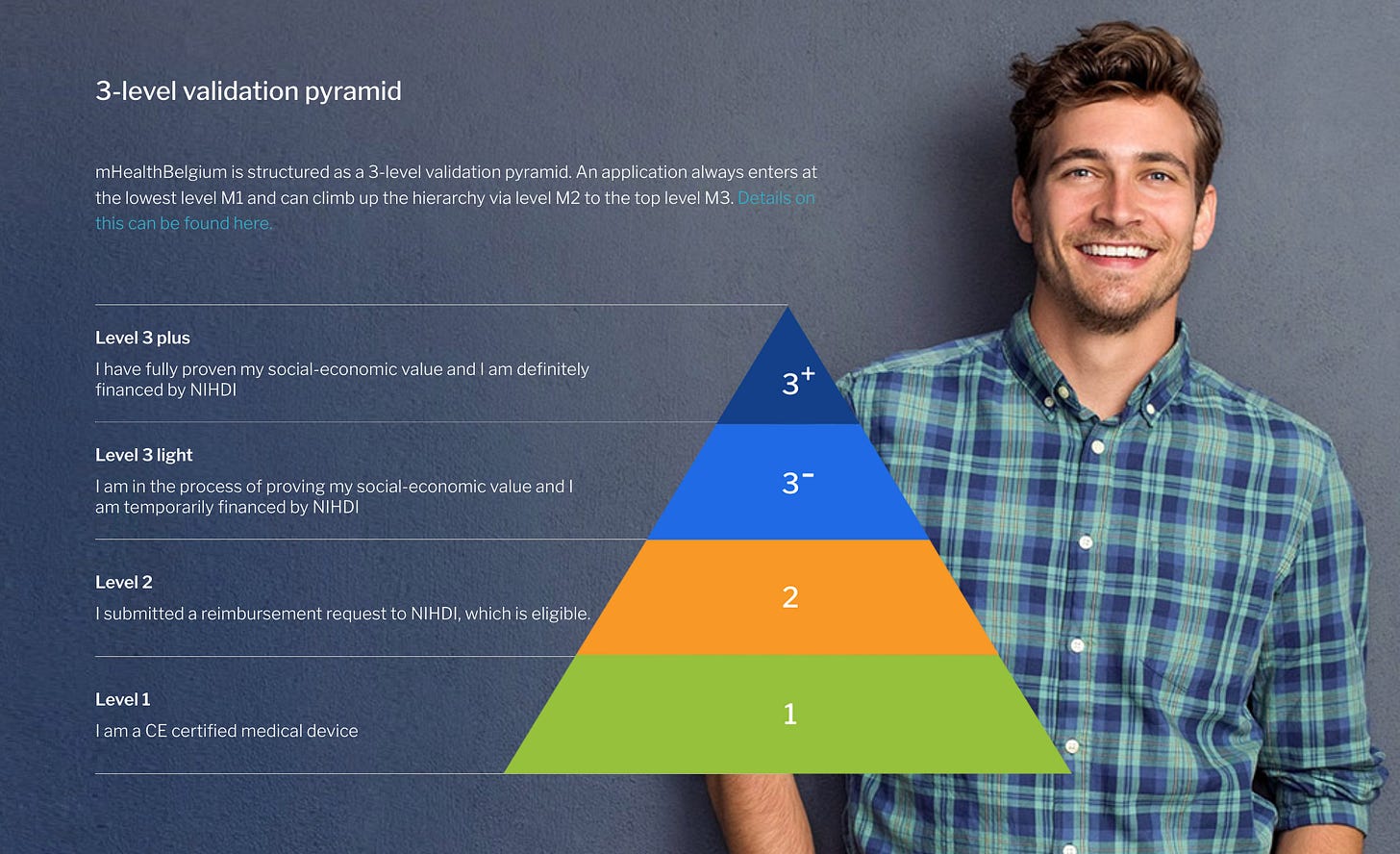

Belgium is rarely mentioned in the DTx discussions but a country that made great progress in setting up the environment for digital therapeutics to thrive even before Germany. In 2016, the Belgian Minister of Health launched a call for mobile health pilot projects. 24 subsidized projects were supported and it became clear after evaluation that a validation framework was necessary. The Mhealth Belgium initiative started as a joint effort by industry and government, with the aim of raising awareness and providing a government-approved listing of medical apps through the mhealthbelgium.be portal. How awesome is this? All the stakeholders together, on a joint mission to give innovation a chance. The validation pyramid with three layers was established by the end of 2018.

Source: Mhealth Belgium.

A unique validation pyramid classifies apps into three levels, starting with basic CE certification and culminating in potential reimbursement, following stringent ICT and economic value criteria. However, success didn’t follow. “The difference between Belgium and the two other countries (Germany and France) who are also embracing the innovation is that they have budgets for this innnovation direction. Sometimes large budgets and they also finance the products themselves,” says Dr. Steven Vandeput, Advisor for Digital MedTech and Services & Technologies Home Assistance in Belgium.

Politics is Everything

Any digital health transformation project needs to start with someone who is willing to set the course of progress and who is willing to fight the windmills. This is what the digital health space will remember Jens Spahn for—he was the German minister responsible for setting up the DiGA framework for digital therapeutics in Germany in 2019. I doubt there is a digital health conference, where DiGA wouldn’t be mentioned when talking about digital therapeutics. The success of that framework in 2024 is debatable.

By the end of 2023, 374,000 prescriptions were issues and costing the German healthcare system 113 million euros. Some argue the uptake is too slow, while optimists point to the positive trend of rising numbers of prescriptions. A positive recent change for patients is that in the past, they had to wait up to two weeks to get the reimbursement code from insurance companies. In 2024, this has now been reduced by a two-day rule.

The reality check in 2024

As nicely shown by the overview below, provided by Galen Growth, four countries in the world have a clear framework for digital therapeutics.

Source: Galen Growth.

But we still have a long way to go. The remuneration amounts in Germany agreed between the National Association of Statutory Health Insurance Funds (GKV-Spitzenverband) and the manufacturers, or determined by the arbitration board are on average 221 euros, which is half less then manufacturers initially imagined.

Manufacture prices (gray) vs negotiated reimbursement prices (red) with GKV-Spitzenverband for Digas. Source: National Association of Statutory Health Insurance Funds (GKV-Spitzenverband)

In France, only one solution has been approved so far through PECAN. But to be fair: the pricing range for digital therapeutics has only been introduced in a few months ago. After the experience in Germany, where solution providers set their prices and then re-negotiated them, France wanted to give innovators predictability with pre-set reimbursement rate. DTx gets a flat rate of €435 including VAT for the first three months for a digital therapy. This includes a 20% tax, causing the actual amount to be even lower. The maximum cost of DTx that is reimbursed is €780 per patient per year - a limit set to manage healthcare expenditure, and a limit that was developed through discussions with many industry stakeholders, was explained at the DTx France 2024 conference.

One obsticle companies face is providing clinical evidence for their solutions. As mentioned at DTx France 2024 conference, there is a need for funding well before the start of PECAN to finance this clinical study, which is a significant investment for startups.

At least two challenges for DTx exist on all markets:

Patients and doctors need to be aware of DTx, and startups don’t have marketing budgets the size of Pharma to make enough noise.

Doctors need to not only be aware of DTx, but are in addition expected to explain them and train patients in their use. Is anyone surprised they want to be paid for that effort?

What seems to be working?

Creativity in business models.

Partnerships with consumer brands and pharma.

Value-based contracting.

Let’s look at examples.

FibriCheck is a medically certified detection and monitoring application that can be used to detect or monitor an irregular heart rhythm, such as atrial fibrillation. FibriCheck can be downloaded from the App Store or the Play Store, or can be prescribed by your physician. You can measure your heart rhythm by placing your finger on the camera of your smartphone. It was developed in Belgium, and when it became clear, that the insurance and DTx frameworks path will make it difficult to scale, the company partnered with Fitbit smartwatch to detect heart rhythm irregularities.

In 2021, Vicore Pharma decided to develop a DTx for anxiety specifically designed for patients with pulmunary fibrosis (PF). It was meant to be a complimentary but stand-alone treatment. Instead of developing it in-house, Vicore Pharma AB partnered with Alex Therapeutics - a DTx software design specialised company. “We started from nothing, setting up interviews with pulmonary fibrosis patient groups as a first step. Alex Therapeutics have designed and built the front and back end and cognitive-behavioral therapy expertise, but Vicore Pharma contributed the clinical information on pulmonary fibrosis, connected with key-opinion leader in the PF space and PF Community, designed and financed clinical study study. I think a division like that works really well,” says Jessica Shull, Director of Digital Health at Vicore Pharma AB. In March 2024, the solution called Almee received FDA Breakthrough Designation.

Digital therapeutics, with their potential for exponential scalability and reduced marginal costs, fit well into the value-based contracting model, says Aaron Gani, Founder and CEO of RealizedCare, formerly known as BehaVR. As he says, DTx appeal to risk-bearing, value-based entities by promising enhanced member engagement, improved health outcomes, and overall savings, without the entities worrying about specific reimbursement codes. Focusing solely on CPT codes and fee-for-service reimbursements overlooks the broader opportunities presented by value creation. In July 2024, the U.S. Centers for Medicare & Medicaid Services (CMS) issued new changes to their Shared Savings Program for 2025, which opens up new possibilities for DTx companies in the US.

Now what?

To answer the question in the title of the newsletter, the story of DTx is far from over.

Investor Marko Kuisma believes that from a VC investors’ perspective, this might be a good time to invest in DTx, as valuations have returned to a meaningful level after the 2020-2021 hype. “For VCs, taking risks on various factors is business as usual, and the key question is, which risks are you comfortable taking – e.g. are you willing to take an efficacy / evidence risk, technological risk, or market / GTM risk,” he says.

It takes over ten years to bring a drug to market. It takes between 3-7 years to bring a medical device to market, and a lot longer for it to become a standard of practice.

Should we give up on DTx? Not quite yet.

Tune in!

Faces of digital health podcast related to DTx.

DTx in 2024: Where Are We With Business and Reimbursement Models? (Andy Molnar, CEO of Digital Therapeutics Alliance)

DTx in Belgium: It's Time to Embed Digital Therapeutics in Clinical Pathways (Steven Vandeput - Medtech Advisor)

How Do Pharma and Digital Health Converge in 2024? (Amir Lahav, Pharma Consultant)

Innovation at Charité, The Problems With DiGAs and the German Market (Dorothée Marie-Louise Döpfer)