France wants to become the leader in digital health. How did they approach the vision?

...with determination, public involvement, and concrete funding. And after Germany, all eyes are on France and the success of its Digital Medical Devices (DTx) reimbursement process.

This is a monthly newsletter of Faces of Digital Health - a podcast that explores the diversity of healthcare systems and healthcare innovation worldwide. Interviews with policymakers, entrepreneurs, and clinicians provide the listeners with insights into market specifics, go-to-market strategies, barriers to success, characteristics of different healthcare systems, challenges of healthcare systems, and access to healthcare. Find out more on the website, tune in on Spotify or iTunes.

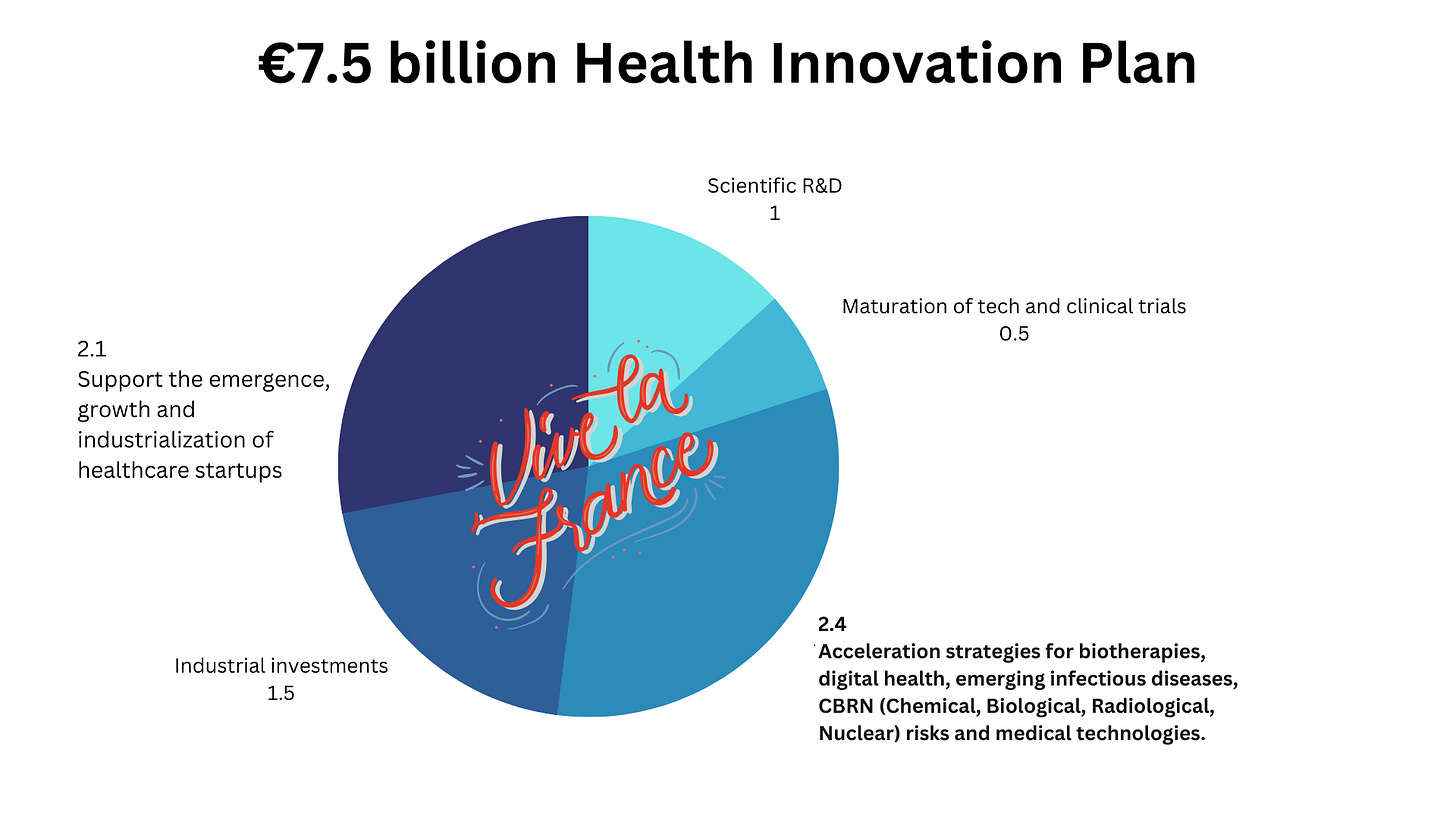

In June 2021, France announced a €7.5 billion Health Innovation Plan, as part of a broader financial investment to boost the French industry. This funding goes beyond digital health, it’s aimed at supporting biotech development, startups, MedTech, and more:

Within the context of the 2021 €7.5 billion Health Innovation Plan, funding for digital health initiatives is allocated as part of the 2.4 billion EUR fund for the acceleration of biotherapies, emerging infectious diseases, CBRN (Chemical, Biological, Radiological, Nuclear) risks, medical technologies, and digital health.

The Healthcare Innovation Plan was published in 2021, but several things happened in the preceding years: A reform program entitled “My Health 2022” was drafted, and included a law on the organization and the transformation of the health system in France. This law was adopted in July 2019.

Decision-makers didn’t just analyze other countries but also conducted nationwide research and public consultations, which showed significant differences in understanding of healthcare digitalization and digital health needs in different parts of the country. Consequently, two things were acknowledged: the need for evidence and establishing trust in digital solutions, and the need to support local initiatives.

To realize the ambitions of healthcare’s digital transformation, a Ministerial eHealth delegation was established in 2023 inside the Ministry of Health.

Upskilling the workforce

Apart from giving a financial boost to innovators, France is dedicating specific funding to decrease the widespread deficiency in digital skills and comprehension of digital health technologies with the National Health Acceleration Strategy, valued at 734 million EUR. What will it do?

In the academic year 2024/2025, digital health will be included in the curriculum for healthcare professionals.

Existing workers in nursing homes, social care, and the medical sector will receive additional training for upskilling in digital health.

“It's important to know that these strategies cannot just be built in the health framework, but also concern the digital and economic sectors,” says Louisa Stüwe who is the project director of the Ministerial eHealth delegation at the French Ministry of Health.

That’s why the Acceleration Strategy was not prepared in silo but in collaboration between the Ministry of Health, the Ministry of Economy, Finance and Recovery, the Ministry of Higher Education, Research and Innovation, and the General Secretariat for Investment (SGPI).

Around 400 million EUR will have been deployed until the end of 2023.

Digital health and Digital Medical Devices

Since 2019, the world kept looking at Germany with admiration around their streamlined DiGA process for the reimbursement of digital therapeutics (digital medical devices with a proven impact on treatment outcomes). The challenge before DiGA was that companies in Germany, providing digital health solutions, had to negotiate with each German insurance company separately to get approval for reimbursement. There are over 100 insurance companies in Germany. When the DiGA process and repository were introduced, all insurance companies were required to provide reimbursement for the approved solutions. If and when they were prescribed. Unfortunately, while overcoming the payment hurdle was significant progress, it didn't eliminate the need for startups to persuade clinicians to prescribe these solutions. Startups had the freedom to determine their initial price, which would support their business models. However, the price had to be re-negotiated and adjusted after a year. This was fatal for some companies.

2023 Setback for DTx

In 2023, the German health tech company Aidhere which provided a DiGA for weight reduction in obesity, had to file for insolvency after long-winded price negotiations with the insurers in Germany decreased the initial price by more than half. This wasn’t the only bad signal for the DTx industry.

In May, the market was shocked by the file for bankruptcy of Pear Therapeutics - a US company that had developed a range of apps to help treat addiction, insomnia, PTSD, chronic pain, irritable bowel syndrome, and more. Its substance use disorder program, reSET, became the first-ever digital therapeutic to receive FDA clearance in 2017.

To avoid shocks like that, France is approaching the pricing and approval process differently than Germany. How?

Telemonitoring and Digital Therapeutics Reimbursement in France Process

Stage 1: Documentation and Temporary Approval

Companies wishing to offer software as a medical device solution in France, need to prepare 2 documents:

Scientific evidence, which is submitted to the French National Authority for Health (HAS),

An interoperability document, submitted to the National Digital Health Agency (ANS),

The healthcare ministry does the final assessment for approval and listing to the national directory of prescribable apps.

This may sound like a lot of bureaucracy and time. However, according to Louisa Stüwe, it should not take longer than 90 days for companies to get feedback and be temporarily listed on the pay list.

Pricing

Unlike in Germany, where a company can get unpleasantly surprised by significant price drops after a year, France has predefined prices. Companies can see in advance what price to expect for their solution. This isn’t bringing any guarantees for success though, says Louisa Stüwe. “The challenge that we all face will be the volume part because we can't predict how much these solutions will be prescribed in France. We know that digital health training and so on will give doctors good ground for prescribing, for patients to adopt solutions, and so on. But maybe this is not enough and we face uncertainty about the reality of prescriptions of digital therapeutics.”

Stage 2: Data Collection For Permanent Listing

Companies need two types of data; first, for application submission, and then for the validation of a solution on the French market.

For approval: companies can submit data and evidence coming from outside of France.

As soon as the company gets approved and available on the market: it needs to start collecting data and evidence of the solution’s efficacy in France. In 6 months, enough evidence needs to be gathered and submitted, so the solution gets a permanent listing after a year. Telemonitoring solutions can gather data for 9 months.

Speaking of data, as of 2022, France has been unlocking fresh opportunities for the mining of French health data.

Secondary Use of Data in France

If we kept looking at Germany because of DiGA, Finland is still reaping admiration for the establishment of Findata - Finnish Social and Health Data Permit Authority that grants permits for the secondary use of Finnish social and healthcare data to national and international applicants.

France is enabling the secondary use of data through its National Health Data System (SNDS) which stores:

health insurance data (SNIIRAM database);

hospital data (PMSI database);

the medical causes of death (base of the CépiDC of Inserm);

disability-related data (from MDPH - CNSA data);

a sample of data from complementary health insurance organisations.

SNDS has health claims data for 95% of the population. “This data has been linked since 2022, when the health reform has been adopted. This has been a little revolution in terms of the availability of health data,” says Louise Stüwe. SNDS is a collection of non-static, non-granular administrative health data databases that enables finding patient cohorts and matching clinical data with administrative data.

Requirements For The Use of French Health Data For Secondary Purposes

Interested researchers need to submit their scientific protocol to the French Health Data Hub which is responsible for granting or rejecting data research requests. Health Data Hub assesses if researchers require the minimum possible data set to answer the research objective. What have researchers been looking into so far?

“Some of the projects try to check how to make patient management more efficient as a result of new organizational methods. Others, for example, check how to predict individual patient trajectories and improve prevention actions towards them. Research can be used for future responses in situations such as a pandemic. This data can also prevent and help to give the best political and scientific evidence to formulate public policies and responses to that,” Luisa Stüwe says.

The key requirement to get a request granted is that research serves the public interest. Academic researchers can get free access to the national database, public structures will get charged.

Thus far, France has demonstrated that its digitalization ambition extends beyond mere strategic documents. To gauge the success of the digital medical device process, we may have to wait another year or two.

Don’t miss!

Amidst a flurry of healthcare events in Q4 2023, one stands out in Europe: The Economist Impact Future of Health Europe Event, which will take place on Oct 11-12 in London. The summit focuses on health economics, sustainability, inclusivity, and digital health. So attend and connect with the architects of change – government, policymakers, regulators, healthcare providers, patients, and advocates – at this pivotal event. Seize your opportunity to help shape the future.

Before You Leave: Get Updated On LLMs and AI in Healthcare

What Are Investors Betting On in Generative AI in Healthcare?

Generative AI is definitely the word we will remember 2023 by. Knowing that administrative burden is among the key reasons for physician burnout, the idea that AI could tackle this and other challenges, became a little bit more tangible with the raised awareness and public understanding of generative AI. But where are we exactly, and how is generative AI utilized for clinical use cases, administration, patient care, and biotech?

How Can Generative AI "Super Staff" Healthcare? (Munjal Shah)

Hippocratic AI is a US startup, building a healthcare-specific large language model (LLM) that could impact workforce capacity. Not by suggesting diagnosis, but by focusing on lower-hanging fruits such as test results delivery and explanation, answering patient questions before medical procedures, and more.

How Can AI Help Predict Patient Drug Response? (Genialis)

Drug development has always been and remains expensive. Estimates are conflicting. The long-cited number to bring a drug to market has been 3 billion US dollars. A 2020 study corrected that estimate to be between $985 million and $1.3 billion per new drug. Latest research raises the estimate to whooping $6 Billion.

Needless to say, we could use optimization, since new drugs are essential for improved care and quality of life of patients. Companies such as Genialis use machine learning and omics data to better understand disease biology and consequently predict patient responses to targeted therapies based on their specific phenotype.

Thanks a lot for the summary, I shared it in my network!